Building digital infrastructure share networks

Over the past few weeks, I have been interacting with as many business and people as I can. The goal is to choose a platform for electronic fund transfer, which is why we haven't embedded this function yet.

The generation that is shaping our future economy doesn't understand the importance of product compatibility quite like my generation. They didn't live through the VCR vs. Betamax era, where you had to pick a side of the movie rental store and cross your fingers. The iPhone vs. Android battle remains a nuisance, but software advances have helped to force cross-compatibility. In day to day life, these are annoyances, but it is the behind-the-scenes incompatibilities in our businesses -- including healthcare -- that is really costing us time and money. We will see incredible benefits as a community by standardizing our digital infrastructure. MoveUP will be an example of that, allowing us to share a single transportation platform.

Over the past few weeks, I have been interacting with as many business and people as I can (mind, while maintaining a safe, virus-free distance). The goal is to choose a platform for electronic fund transfer, which is why we haven't embedded this function yet. It's an important choice, because we will see far and away the greatest benefit if we all adopt a single platform.

Let me 'splain:

A bank is where you keep your money, and this is a personal decision. You may have a nearby branch or ATM, you may be a credit union member, you may have a mortgage with a particular company, whatever. We have been moving from cash to plastic for a long time, and most are aware that using a credit card costs money -- the merchant pays fees for its customer's convenience. You may not think about it, but we all pay those fees, it's just they are worth it. Progressively, ways of moving money electronically have emerged, like PayPal. These companies allow electronic fund transfer, and we are doing this more and more.

Unlike a personal bank, electronic fund transfer is all behind the scenes. It doesn't matter how it happens so long as it is easy, secure, and inexpensive.

Because these companies make money on transactions, the more transactions, the more money they make, and the more it all costs us. Transactions between systems such as from PayPal to a bank are more difficult, less secure, and more expensive. Internal transactions -- PayPal account to PayPal account -- are easy and flexible, more secure, and much less expensive or even free. Because we don't see any of this, if we all adopt a unified system, we will all get a lot more for our money.

But boy is it hard to get people to agree on anything!

As they grow and fight for market share, many of these company's offerings are beginning to overlap, like PayPal, Stripe, and Square. PayPal started as a way for online vendors such as people selling on Ebay to accept electronic payment without having a contract with a credit card company. Stripe is another electronic fund transfer company primarily for online transactions. Both companies are now expanding into the small business market with systems allowing in-person payments, because there are different needs for each.

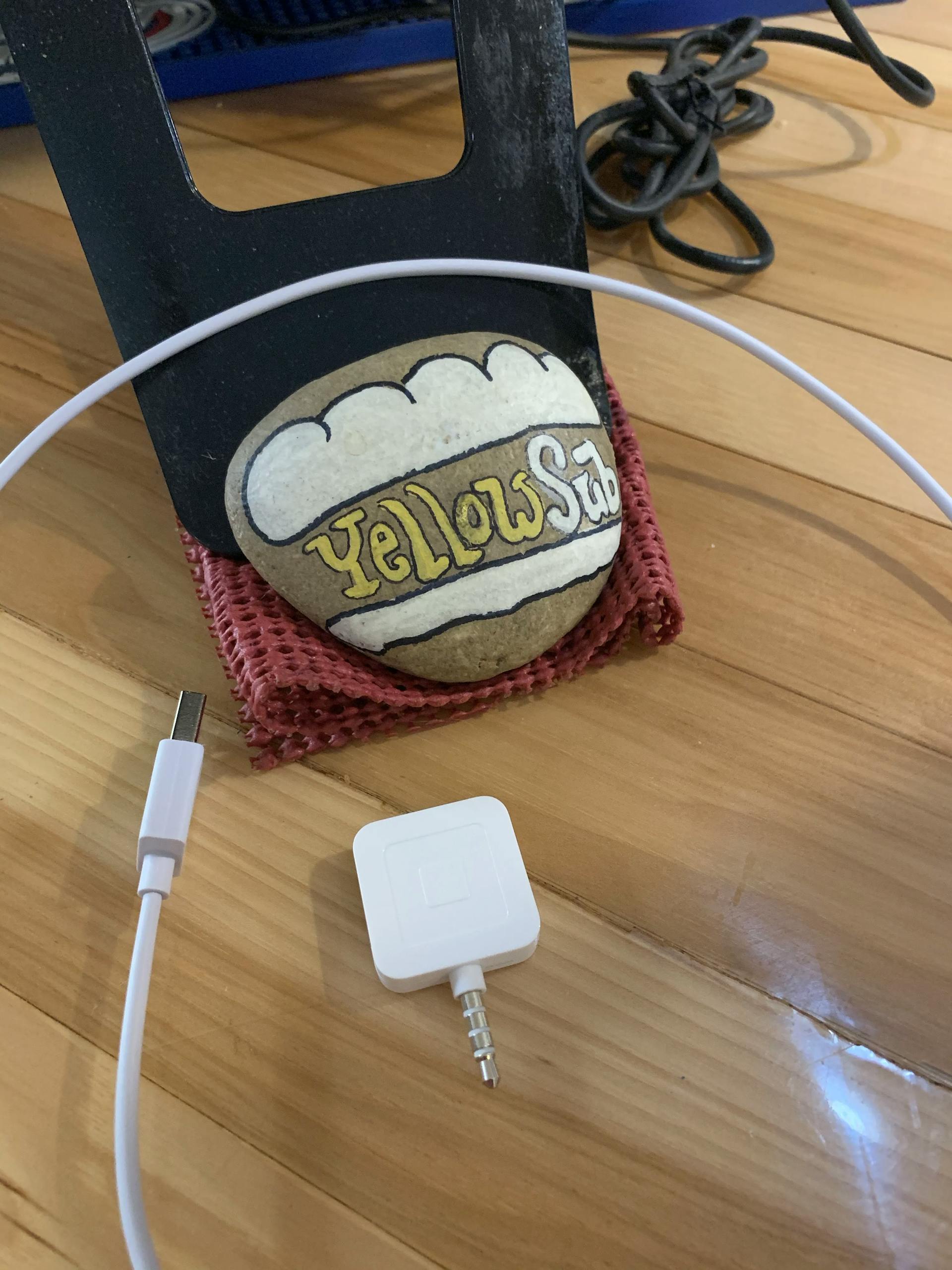

Square began as a company that allowed in-person transactions from people on-the-go such as a plumber or a food truck to accept credit card payments anywhere and without a fixed cash register. Because of its roots, it has led the way in products designed for small business owners, and is now expanding its own offerings to include things like accounting and payroll. And electronic fund transfer.

As we try to find a path that is best for us, easing the transitions of the long-establish small business into the digital world is a top priority. I am seeing the real-world challenges of connecting a very analog restaurant with a digital delivery network, and many of these businesses will not survive if we don't do something to help. The ability to work on a massive scale is the sledgehammer that Walmarts and Dollar Generals use to smash small local competitors out of existence. This is why I am leaning toward integrating square into MoveUP. I believe this will not only give us an electronic fund transfer platform that is essentially equal the its competitors, it can be more easily integrated into small businesses that currently lack these capabilities giving us greater flexibility, increased security, fewer transaction fees, and minimizing costs for everyone.

This doesn't mean that if you currently operate a restaurant or small business using another vendor that you will have to switch -- if it ain't broke, don't fix it. We already have a connection to the online e-commerce platform Ecwid, and this is a flexible and inexpensive way to move into the digital world if you remain a hold-out, like many of our iconic watering holes. This is not about forcing personal preferences like banks, this is about the shared network that connects it all together. That's where the real money is.